Market Update

May 2024

I hope your spring is off to beautiful new beginnings! Godspeed to my teacher friends and parents of littles these last few months of school.

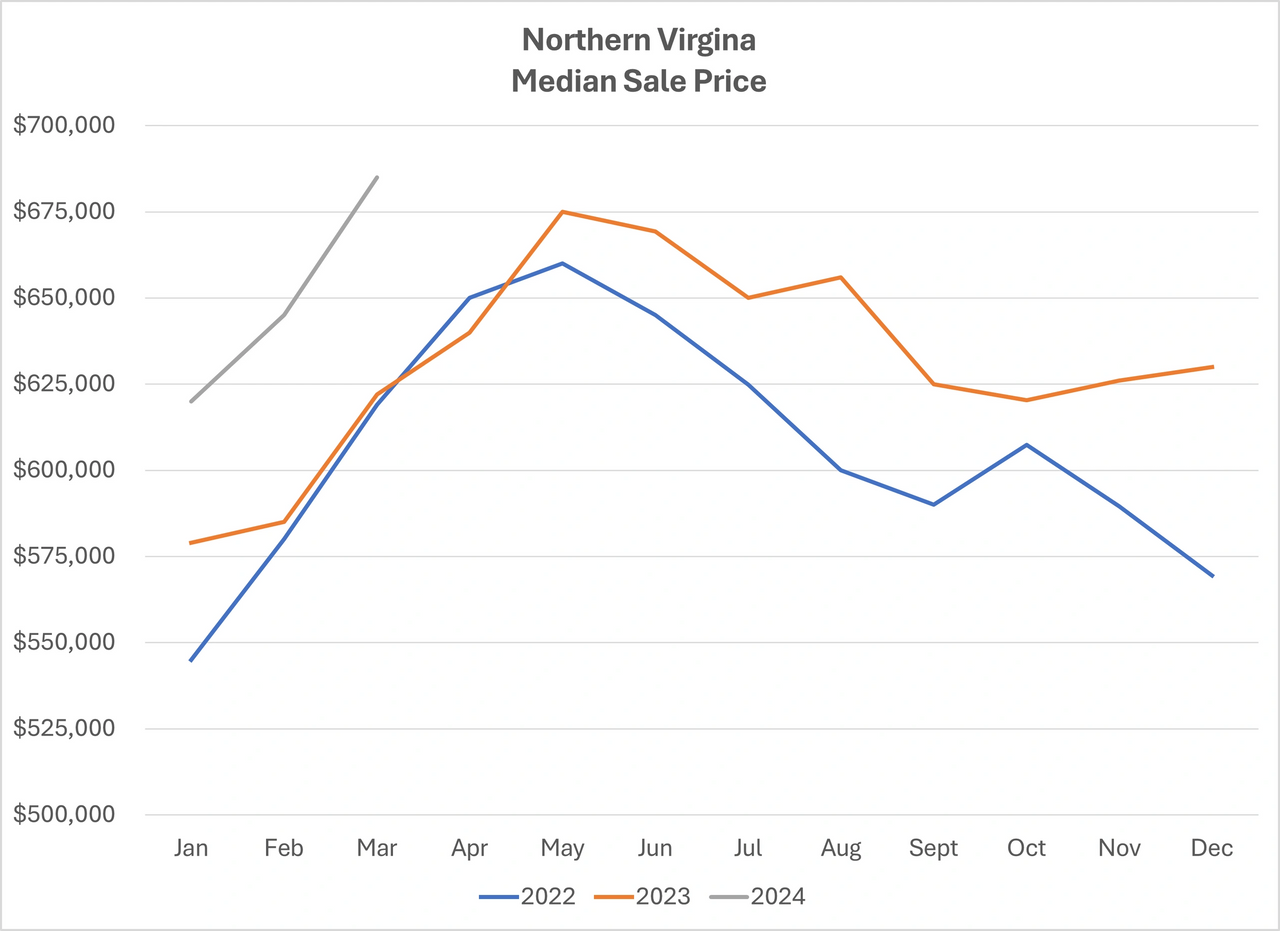

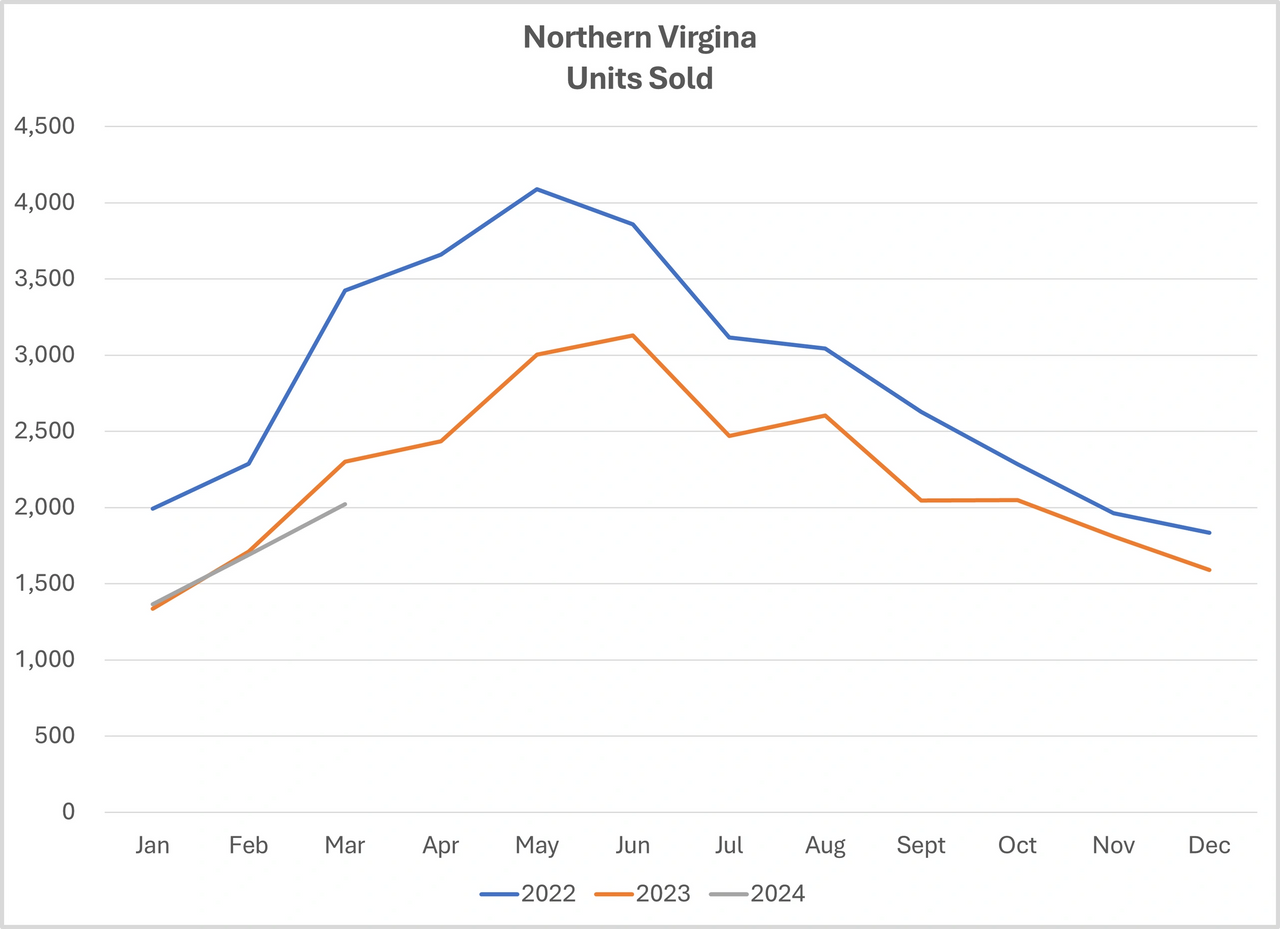

As you will see below, I have put together two charts to share with you this month. Both represent all residentials sales within Northern Virginia (Arlington, Alexandria, Fairfax, Loudoun, and Prince William Counties and their jurisdictions) since January 2022. I find this information useful to get a sense for trends, although it is not a substitute for hyper-local data.

The first chart tracks the median sale price. Apart from last spring, sale prices in 2023 were higher than 2022. So far this year, prices are even higher. What this chart does not show is the variance between the list price, contract price, final sale price, or concessions. Nor does this chart note the number of days on the market. These are all important considerations when pricing your home or making an offer. The chart simply reflects whether final sale prices throughout our region are higher or lower than in prior months and years.

The second chart displays the number of residential sales. These numbers are transactions closed per month. Most of these sales were under contract 30-45 days prior to closing. Prior to being under contract, they were active on the market for a few days to a few weeks. For instance, many of the 2,023 closings this March were on the market shortly into the new year. We see the amount of sales increase through the spring as buyers become more active. The people closing on their home in the first quarter were likely shopping for that home in the winter. This is often why I often suggest going on the market in the new year.

When I am asked about the state of the market, I briefly consider the trends in these charts. However, the answer is relative to where you live, the circumstance of the sale, the condition of the home, your timeline, and recent sales of like homes within your neighborhood. These are all factors not accounted for in general data and in online algorithms.

The National Association of Realtors (NAR) settlement received preliminary approval. Once fully approved, brokerages and Multiple Listing Services (MLSs) have 120 days to implement changes. One of the terms of the settlement is the requirement of a buyer representation agreement. This has been a requirement in Virginia for 12 years so this will not be an adjustment in our market as it is for many others. The second requirement will be to remove any buyer agency compensation from the MLS and any syndicated services (i.e. Zillow, Realtor.com, ShowingTime). Ironically, there was a Department of Justice (DOJ) suit in 2020 requiring full transparency of all broker fees paid within a transaction. We, practitioners, are just as curious as everyone else to see how these suits will change the home purchase and sale process, if at all.

I have been participating in a real estate class these last few days where there is no shortage of opinion or speculation. Many of my thoughts seem to be in the minority, however there is one part of the suit I believe is severely misunderstood. There seems to be a misconception Realtors have caused the increase in home prices. Home prices are a result of market conditions, just as the cost of milk and gas. Prices remain high until the consumers decide they can no longer afford a product and demand diminishes. Homes are going under contract within days with few or no contingencies. That would not occur if there was no demand for homes, or buyers could not meet the terms of their offers. Our suggestion for a list price reflects what is happening in the market. If we suggested anything less, we would not be doing our job for sellers, which is to maximize their net proceeds.

I would love to know your thoughts! Drop me a line to continue the discussion or if you would like data for your neighborhood.

More About NAR

April 2024

Some more insight into the NAR lawsuit…

It is important to note the lawsuits have been ongoing for years. (Yes, there are more than one.) Equally important to note is the judge has not approved the settlement proposed by the National Association of Realtors (NAR). Everything you have heard and the consequences, good or bad, are conjecture. The earliest we expect to receive any formal guidance is July. Meanwhile brokerages and Realtors are trying to navigate the anticipated changes within the existing structure.

For example, as of now, buyers are not able to finance their agent’s commission. Unless/until lenders can make this possible, it will require buyers to bring more cash to the closing table. The inflated prices in our area over the past few years have already prevented many people from becoming home buyers. Regulations for Federal Housing Administration (FHA) and Veterans Affairs (VA) loans will further marginalize those buyers. The only way for all buyers to eliminate or reduce the cash necessary to close is to ask for a seller subsidy. With this arrangement, debits and credits resemble the current compensation model on the American Land Title Association (ALTA) statement. It is simply a new route to the same destination.

One of the many tedious aspects of the NAR lawsuit for Realtors is navigating the laws. If we charge everyone the same among (i.e. x%), it could be construed as price fixing. If we do not charge everyone the same amount, it could be considered price discrimination. With this tightrope, coupled with low barrier of entry to the profession and self-regulation, a suit was inevitable.

I will continue to remain flexible with compensation. No two sales require the same level of time, energy, and upfront financial investment. Marketing strategies differ as do our expenses depending on the location and size of the home. I strive to propose a plan that meets specific needs, reduces the mental and physical load of the process for the client, and adjust compensation accordingly. More recently I have been exploring flat fee real estate services. Alignment with Real Broker, LLC has given me the opportunity to explore this model further.

In addition, I now offer á la carte downsizing services. Until now, and for many reasons, I opted to only offer downsizing services as part of the home sale agreement. Thanks to many inquiries, and much encouragement and guidance, I can now offer a downsizing service for an hourly fee via my new LLC, RHC Downsizing, LLC. I suspect this service will look a little different for everyone and will continually be refined. If you are considering downsizing or want to know more, I’m happy to talk with you and create a solution for your specific needs. All questions welcome!

NAR Lawsuit

March 2024

As many of you have heard the National Association of Realtors (NAR) has settled. If you are not familiar with the suit, that’s OK. While the suit is complex, affecting national, state, and local law, here is the gist:

For years sellers have been told the commission rate to sell their home is 6%. Typically, the commission is split between the listing agent (representing the sellers) and the buyer’s agent in a sub agency arrangement. What many do not know is the rate is, and always has been, negotiable. Having a set commission rate violates antitrust law and could be considered price fixing. Many sellers were not informed the rate is negotiable, nor were they told they are not required to include buyer’s representation.

Prior to the 1990’s buyer representation did not exist. Essentially every Realtor worked for the seller. Many homebuyers were not informed of their rights or educated about federal, state, and regional laws. Buyer representation began to protect the buyer’s best interest. It also streamlined the home sale process for both parties.

When a Realtor represents both sides of a transaction, it is called (in Virginia) dual agency. Dual agency is akin to having a coach for two opposing teams on the same field. It is unlawful in many states and prohibited by some brokerages in others. Buyer agents bring the prospects to the home and help their clients with the purchase. They bridge the gap between their buyer’s goals and the options available. The commission rate was split to compensate for this function of the sale.

This arrangement has begged many questions, hence the lawsuit. For instance, if the seller is paying the commission from the proceeds of the home sale. Why are they “paying for” buyer representation? The seller has been required to agree to the rate and splits prior to listing the home. Are buyers paying higher prices for homes to compensate for this expense?

We, Realtors, learned about the settlement in the news, at the same time as everyone else. It will take some time to see how this could/will impact the home sale process and the financial implications. In a nutshell, NAR works at a national level to protect consumers and real estate professionals. It established ethical standards for the profession, influences legislation, and provides and regulates continuing education. Virginia also has an association, Virginia Realtors (VAR). It provides many of the same functions according to the Commonwealth’s laws. The regional associations, Northern Virginia Association of Realtors (NVAR) being the most prominent, help determine how to implement the processes and regulations into practice.

Many of the tools we use to do our job require membership of all three associations. The decisions made at every level affect what we do and how. Until the impact of NAR’s decision reaches the state and local associations and if/when brokerages adjust their models, the result of the settlement remains to be seen.

There is a lot of speculation about the future of home sales and that is all it is...speculation. Many people presumed the real estate market would collapse when the pandemic hit, and they could not have been more wrong. We navigated those challenges, and we will again. If you are comfortable with some ambiguity for the time being there is no need to postpone your goal whether buying or selling.

I am happy to expand upon any of the information I have shared, explain the intricacies of commission in greater detail, and share my opinion about it all. All questions welcome!

Shift Happens

January 2024

I hope you had a lovely holiday season and your 2024 is off to a great start!

Like recent years, the housing market is full speed ahead this month, a big change from late 2023. While the change is not yet captured in the data, colleagues have reported the shift, and I am seeing it with my own listings. A case study:

When I met with a seller in November, the data was not promising. This home is a four-level condo in a small section of our neighborhood. There are two models within this subsection, and all are the same age, four years. There is very little differentiating them structurally. Since the beginning of August there have been six sales. The days on market (DOM) for the six sales range 6-83 with an average of 34. The fi nal sale price (not including concessions) ranged from $505,000 to $567,000, averaging $530,000. (Ironically the highest sale price was also on the market for the least number of days.)

We worked on preparing the house for sale during December and compiled marketing materials in the fi rst part of January. The home has been in coming soon status since last Thursday. (Coming soon allows us to pre-market the property. Showings are not permitted until the status is changed to active.) Since last Thursday we have received two sight-unseen offers and, as of now, there are twelve showings scheduled throughout the fi rst three days the home will be active.

Prior to finalizing the sale price, I spoke with a few of the listing agents of those six sales to learn what feedback they had gathered and if they had any insights into the vast discrepancies of DOM and price. While there are some considerations, the biggest difference is timing.

In a matter of a few weeks, the market shifted.

There is a strong correlation between the recent drop in interest rates and buyer demand. When comparing year-over-year sales, home prices have steadily increased. A lower interest rate is how buyers can afford current prices. In addition, we have seen this trend in January for the last few years. Buyers are starting their search earlier in the year to beat the “spring market.” Perhaps time off from work, visiting a different area, new years’ resolutions, or change in fi nancial status have also been a tipping point for some. So, what does this mean for current buyers and sellers?

Buyers

- Preparation is key.

- Work closely with a lender to become pre-approved vs. pre-qualifi ed. There is a difference.

- Work with a lender that can minimize your risk to waive contingencies.

- Search for homes about $50K less than your pre-approval amount.

- Create a strategic offer when you find The One.

Sellers

- Preparation is key.

- Work with a realtor to determine which tasks yield the best return on investment and to help expedite the tasks.

- While the market is currently in your favor, do not take short cuts.

- Price fairly.

Wishing you all warmth and comfort during these chilly days. I hope to see you soon!

Selling Myths

November 2023

Based on a few recent questions, I am sharing the following home selling myths. May these tips provide some comfort as you decide if a move is in your future.

- I need to upgrade my home before selling. False! My strategy differs depending on many factors, but cosmetic upgrades are not a top priority. I do not believe in investing a lot of money in a home you are going to part with, especially since the value of those upgrades is subjective. If a home does need some TLC, there are companies that partner with realtors and accept payment as closing from the proceeds, vs. requiring payment during the process.

- Spring is the best time to sell a home. Again, false! There are advantages and disadvantages of every season. Given the volatility of the market the past few years, the notion there is a best season has been squashed. However, I do recommend avoiding the summer months if possible.

- When do I contact a realtor? My answer is as soon as you think you might sell, even if that’s months or a year or more in the future. I often get the call as the last step in the process. People are tired from the decision making and unsure if they have made the right decisions. They’ve often underestimated the sales timeline as well.

The earlier in the process a realtor is involved, the more support and assistance they can provide. A true realtor services the people every step of the way. The sale of the home is just one piece of the process.

Wishing you the very best this month. Happy Thanksgiving to you and yours!

Moving Tips

September 2023

Moving to a new home can be an exciting but stressful journey. By finding the right movers and having a good, though flexible, moving plan, most of the common moving headaches can be easily avoided.

Start Planning

Finding the best mover for you at the right price involves a simple evaluation of your needs. Moving companies provide a wide range of services, from planning your move, storing your things, packing and unpacking, to decorating and organizing your belongings in your new home. You can choose which services you want and have them tailored to suit your budget.

Compare Movers

When you compare price and service estimates from several companies, you will find that estimates are based on the weight of your household items, the distance they will be moved, and the amount of packing and other services you will require. Be sure to show the estimator every item that will be moved. Estimates should be done in person and include a clear explanation of rates and charges that will apply, the mover's liability for your belongings, pick-up and delivery schedules, and claims protection.

If you are moving interstate, you should read and understand all of the information you will receive. In addition to brochures explaining their various services, moving companies should give you a copy of a consumer booklet titled "Your Rights and Responsibilities When You Move" and information regarding the mover's participation in a Dispute Settlement Program. Distribution of the consumer booklet and the requirement that movers must offer shippers neutral arbitration as a means of settling disputes that may arise concerning loss or damage on household goods shipments are requirements of the Federal Highway Administration (FHWA).

Be Prepared

Even in the most well-planned moves, something unexpected may happen. In those instances, insurance is crucial. Check with your homeowner's insurance provider about coverage for your belongings while moving. Your mover will provide either released value insurance (about $0.60 per pound of goods lost or damaged, according to NAVL.com) or full replacement value, which you must sign for on your bill of lading. If you are not sure how to estimate the value of your belongings for insurance purposes, your insurance carrier can help. Items of special value such as heirlooms, paintings, or collectibles can be insured under separate riders. In the event of damage to an item, file a claim immediately. Be sure to save the packing materials to show to the adjuster, should there be any problems.

Packing Up and Moving On

Once the time has come to start packing and organizing, here are some tips to make the process smooth:

- Start by packing the things you use most infrequently.

- Pare down items that have accumulated over time by grouping them into 3 categories Keep, Donate, or Throw Away.

- Create an inventory sheet of valuables and a list of which boxes they were packed in.

- Label your boxes according to the rooms where they'll be moved - bedroom #2, 1st floor bath, etc. Consider using different colored stickers/tape for each room.

- Provide your movers with copies of the floorplan of your new home, so they can move more efficiently without having to stop and ask you where things go.

- Try to keep boxes under 50 lbs. whenever possible, put heavier items in smaller boxes to reduce bulkiness, and place lighter items in larger boxes.

- Dispose of items that can't be moved, like flammable liquids, cleaning fluids, etc. Prepare your mower by emptying the fuel and recycle your propane grill tanks.

- Snap a photo of the back of electronic devices so you know which wires to attach when setting them up in your new home.

- Pack an overnight bag with moving day essentials, including toiletries, clothes, medications, and charger cords.

- Courtesy of Cloud CMA

Intelligent Pricing and Timing

August 2023

Pricing a home for sale is as much art as science, but there are a few truisms that never change.

• Fair market value attracts buyers, overpricing never does.

• The first two weeks of marketing are crucial.

• The market never lies, but it can change its mind.

Fair market value is what a willing buyer and a willing seller agree by contract is a fair price for the home. Values can be impacted by a wide range of reasons, but the two biggest are location and condition. Generally, fair market value can be estimated by considering the comparables - other similar homes that have sold or are currently for sale in the same area.

Sellers often view their homes as special, which tempts them to put a higher price on it, believing they can always come down later, but that's a serious mistake.

Overpricing prevents the very buyers who are eligible to buy the home from ever seeing it. Most buyers shop by price range and look for the best value in that range.

Your best chance of selling your home is in the first two weeks of marketing. Your home is fresh and exciting to buyers and to their agents.

With a sign in the yard, full description and photos in the local Multiple Listing Service, distribution across the Internet, open houses, broker's caravan, ads, and email blasts to your listing agent's buyers, your home will get the greatest flurry of attention and interest in the first two weeks.

If you don't get many showings or offers, you've probably overpriced your home, and it's not comparing well to the competition. Since you can't change the location, you'll have to either improve the home's condition or lower the price.

Consult with your agent and ask for feedback. Perhaps you can do a little more to spruce up your home's curb appeal, or perhaps stage the interior to better advantage.

The market can always change its mind and give your home another chance, but by then you've lost precious time and perhaps allowed a stigma to cloud your home's value.

Intelligent pricing isn't about getting the most for your home - it's about getting your home sold quickly at fair market value.

- Courtesy of Cloud CMA

Online Home Valuation Tools

July 2023

Plenty of sellers have utilized automated home valuation tools online only to be shocked or surprised at the home value it estimates for them. While sellers are typically pleased when the values appear higher than they expected, many online instant valuations come in far lower.

Estimating a home's market value is far from an exact science. These tools attempt to provide greater transparency in home prices to homebuyers and sellers by using data derived from public records, which contain past sale information and yearly real estate taxes. Many even have satellite views so accurate they can spot your cat laying on the front porch.

How do they do it? Home valuation sites contract with major title companies to obtain county tax roll data. All property is registered with the county for property taxing purposes. They also find ways to become members of local multiple listing services, which are either subsidiaries of real estate associations or owned by local real estate brokers. That way, they have access to listing data.

Using this tax roll data and listing data, home valuation sites apply their own algorithm to come up with an instant estimate of value for what a home could be worth. Zillow has dubbed their version of this automated valuation a "Zestimate". They disclose on their site that depending on where the home is located, their Zestimate could be off by as much as 40%.

The quality of the data available means that sometimes the results are spot on, but they can also be terribly inaccurate. And algorithms can't make adjustments to reflect whether or not a home has been updated, how well it's maintained, or esoteric values such as curb appeal and views.

For that reason, online valuations should be used only as one of many tools to estimate a home's value.

Ask your real estate professional for a comparative market analysis, or CMA. He or she can show you the most recent listings and sold comparables, accurate to within hours or a few days at most.

- Courtesy of Cloud CMA

How to Buy in a Tight Market

June 2023

Increase your chances of getting your dream house in a competitive housing market.

Get prequalified for a mortgage.

You’ll be able to make a firm commitment to buy and your offer will be more desirable to the seller.

Stay in close contact with your real estate agent.

Your agent will be on the lookout for the newest listings that meet your criteria. Be ready to see a house as soon as it goes on the market - if it’s a great home, it will go fast.

Scout out new listings yourself.

Browse sources such as realtor.com and local real estate listing sites. Set up alerts for the neighborhoods and characteristics you’re looking for. Drive through your target neighborhoods, and if you see a home you like for sale, send the address and listing agent’s name to your agent, who can schedule a showing for you.

Be ready to make a decision.

Spend plenty of time in advance deciding what you can afford and must have in a home so you won’t hesitate when you have the chance to make an offer.

Bid competitively.

Your first inclination may be to start out offering something less than the absolute highest price you can afford, but if you go too low in a tight market, you will likely lose out.

Keep contingencies to a minimum.

Restrictions such as needing to sell your home before you move can make your offer unappealing. Remember that, if the market is tight, you’ll probably be able to sell your house rapidly. You can also talk to your lender about getting a bridge loan to cover both mortgages for a short period.

But don’t get caught in a buying frenzy.

Just because there’s competition for a home doesn’t mean you should buy it. And even though you want to make your offer attractive, don’t neglect inspections that help ensure the house is a sound investment.

- Courtesy of Cloud CMA

CMAs vs Appraisals

May 2023

A real estate professional may prepare a comparative market analysis (CMA) for their sellers to help them establish a listing price. The CMA includes recently sold homes and homes for sale in the seller's neighborhood that are most similar to the seller's home in appearance, features, and general price range.

Although the CMA is used to help determine current market value, it does not establish the seller's home value. The CMA is merely a guide to help the seller learn what's happening in their local market, so they can better understand where their home fits in term of an estimated listing price, based on location, features and condition.

Once the home is listed on the open market, a buyer makes an offer, which could be based in part on a CMA the buyer's agent has prepared. CMAs can help buyers better understand the local market as well as sellers.

If the buyer is receiving financing through a bank, the bank will order an appraisal.

Unlike the CMA, a bank appraisal is a professional determination of a home's value. The appraisal is completed by a licensed appraiser, using guidelines established by the Federal Housing Finance Agency, which regulates federal housing loan guarantors such as FHA, VA and housing loan purchasers Fannie Mae and Freddie Mac.

An appraisal is a comprehensive look at a home's location, condition, and eligibility for federal guarantees. For example, a home that doesn't meet safety requirements such as handrails on steps will not be eligible for FHA or VA loans until the handrail is installed or repaired.

Appraisers use the same data in their market research to find comparable homes as real estate agents. While they are also members of the MLS, they also have additional guidelines from the bank to follow that minimize risk to the bank. They will take into consideration - and can adjust values to reflect - the speed of the market and whether prices are rising or falling.

When the appraisal is finished, the bank makes the decision to fund the loan, or it may require the seller to fix certain items and show proof that the repairs have been made before letting the loan proceed. If the loan doesn't meet lending guidelines, the bank will decline the loan.

Despite stricter lending and appraisal standards, most buyers' loan applications go through to closing - nearly 85 percent. One reason for that is that real estate agents are preparing CMAs that are better tuned to lending standards, for sellers and buyers to fully understand not only what the market is doing, but how much lenders are willing to finance.

- Courtesy of Cloud CMA