Instant Offers and iBuyers

August 2025

With advances in technology and new ways to utilize data, some companies have sprouted up to create different ways to sell your property. Basically, they utilize automated valuation models (AVMs) to make quick offers on homes, allowing them to close in a much faster than typical timeframe, and then resell them. From a seller's standpoint, it can eliminate some hassle and uncertainty, but with high "transaction fees" ranging from 7% to 14%, and the likelihood that they will sell the home for more than they paid you for it, you are simply exchanging that smooth and quick transaction for a portion of your equity.

Companies that offer this kind of service are only in limited markets across the country right now. They operate by having homeowners fill out a short questionnaire with information on their home. They feed that data into their AVM, which kicks back an offer price. They make the homeowner a cash offer to close in a short timeframe (typically about a week) and specify what the fee will be to proceed through to closing. Once they own the home, they will repair and spruce it up, and list it for sale on the open market.

It may be tempting to consider such an offer, but keep in mind that this is a straight numbers play. They are determining a price that allows them the room to cover the costs of the transactions as well as the repairs, while still making some profit. Their profit will either come from the fee you've paid or from acquiring your home at a below market price – although it could possibly be a combination of the two. An analysis on one company's transactions showed they were selling homes at an average 5.5% appreciation, on top of their transaction fee. That's a lot of money to leave on the table for a little convenience.

There are other companies beginning to test alternative listing models as well, utilizing technology and AVMs to make 'instant offers' on homes, or to help buyers acquire and move into their next home before selling their current one. As always, it's important to read the fine print and understand what you are agreeing to, if one of these companies expands into your area.

- Courtesy of Cloud CMA

Hello Summer

June 2025

What. A. Spring. The last few months have been a ride! Someone described the Northern Virginia real estate market as a slice of Swiss cheese and it could not be more accurate. With the continuous changes in the policies (i.e. off-market listings), economic uncertainty, and questionable data, it is difficult to sum up the spring market.

When people ask me if we are still seeing bidding wars, the answer is yes. When I am asked if houses are sitting for longer, the answer is also yes. We’re seeing a greater number of price reductions and homes sitting for several weeks, while others are on the market for just a few days and close above list price. Ironically, we can find both on the same street!

I am not yet ready to predict how the first five months of 2025 will influence the second half of the year, but I do have some statistics that are a great snapshot of recent trends. Ekko Title, a local, reputable title company has several offices throughout Northern VA. They periodically posts a summary of their 10 most recent transactions per office. The following information was shared this past week.

The snapshot Ekko provides is the greatest insight into trends around the region and cannot be found among the typical, more general data.

Based on the numbers in the table, 18 of the 40 transactions closed below list price and most sellers paid for the buyer’s representation. Both reduce a seller’s net proceeds.

Just 19 of the 40 purchases included a home inspection contingency, the primary way to gather information about the condition of a home. (Prior to a few years ago opting out of a home inspection was unheard of. Now it is a tactic to strengthen an offer.)

If prices are reduced and sellers are paying concessions, why are buyers still sacrificing their due diligence? The contradiction makes it difficult to conclude if the current market favors buyers or sellers. I believe we are teetering in between and the answer is subject to interpretation. As always, the location, type of home, and price range yield very different stories. I hope to have a more solid slice (😉) of understanding in the months to come.

One of my favorite annual events is coming soon! Registration for the Appraisal Road Show will begin soon. If you would like to have an heirloom appraised, bring it along and enjoy lunch and entertainment while benefitting one of my favorite organizations, the Shepherd’s Center of Northern Virginia.

I hope your summer is off to fun start and you are able to enjoy time off from school, trips to the beach, and celebrate the season with friends and family. If there is anything I can do to support you, please don’t hesitate to reach out.

Spring has sprung!

April 2025

The spring real estate season has been as chaotic as the weather but not for the reasons you might suspect. Bright MLS, our local multiple listing service, made some changes and it has altered how we list and locate properties for sale. The following is one example of why this spring is different.

Former Rule: Off-market listings could only be marketed within the listings agent’s brokerage. The listings were not entered into the MLS and could not be advertised publicly. One of the intentions of this rule was to ensure all buyers had access to all available homes for sale thus upholding Fair Housing Laws.

There are several scenarios when selling off-market makes sense. The former rules presented a challenge, and off-market sales were not common, but I can attest it was possible. In addition, buyers using the MLS to identify homes of interest could rely on the MLS to contain the vast majority of options and transparency.

2024: All off-market sales must be reported in Bright MLS and would have limited visibility. Essentially this was a new reporting requirement. It did not influence market activity.

2025: With seller direction, listing agents can publicly advertise an off-market listing without entering it into the MLS. Off-market homes for sale are openly marketed via social media, email, and networking, etc. regardless of brokerage...essentially anywhere except the MLS and thereby all commercial sites (i.e. realtor.com, zillow.com) it feeds.

Problem: There is no primary source of information. Transactions are happening and not tracked. There is little oversight of laws and regulations, and buyers are no longer aware of all the options. Buyers can be handpicked by sellers, which is the antithesis of Fair Housing.

In addition, buyers and sellers are making decisions based on incomplete information, potentially costing them valuable time, money, and effort. A lack of accurate data could also pose challenges for appraisals.

Marketing to the masses has always, and still does, result in a greater return for sellers. I strongly urge sellers to go “all in” unless a health and/or safety concern prevails. Having access to all listings not only sustains the protections established for buyers, but it also gives them confidence to make offers. Uncertainty often stunts action and inaction stunts sales.

A little reminder…a recession does not equate to a real estate market crash. Nor is there a prediction of a crash in Northern Virginia. It is too premature to assess if/how returning to the office and government layoffs will influence our local market. Hopefully we will have enough reliable data this summer to formulate valuable conclusions. If you are wondering how the changes could impact your goals, call me. I am happy to discuss your personal situation and help you formulate a plan.

State of the Market

March 2025

This year has been quite a ride so far! There has been a lot of speculation about how government layoffs will affect the real estate market. A few viral posts on social media claimed the housing market in DC has exploded with listings. The posts were quickly rebutted by local and national economic leaders. So far there has been little change when compared to the same timeframe last year. Click here to see the comparison by county.

Do we expect a shift in the coming months? Not necessarily. Consumer uncertainty and the return to a daily commute for some could have an impact over time but these factors do not change a few of the reasons our local market has had such low inventory in recent years.

- Homeowners who purchased or refinanced when the rates dropped have been reluctant to surrender their current mortgage terms for the sake of a new home with higher interest rates.

- Sales prices are still strong but that isn’t necessarily good news for sellers if they are unable to afford where they want to go.

- People are living longer in their homes, so the lifecycle of neighborhoods is also longer.

- Some people believe there is a perfect time to sell and are waiting for it or a life event to dictate that decision.

- Some buyers have been priced out of the market by the continuous and steep rise in prices in recent years.

There has been gridlock and it will take some time and/or multiple factors to increase activity and options for everyone.

When the pandemic began, the immediate prediction was the real estate market was going to crash. The desire for different housing, the ability to work virtually, and the historically low interest rates proved otherwise and ignited unprecedented market conditions. We shifted how things are done as a result and we will continue to adapt as necessary. All real estate industries (i.e. brokerages, mortgage lenders, insurance providers, title companies) are constantly finding ways to help consumers meet the challenges of any market condition. Don’t let social media trends influence your goals. Work closely with those you trust to make the best decisions based on your personal circumstance.

I hope you, or someone you know, find this information helpful. More importantly, I hope this finds you well!

Time in the Market Beats Timing the Market

January 2025

Trying to decide whether it makes more sense to buy a home now or wait? There’s a lot to consider, from what’s happening in the market to your changing needs. But generally speaking, aiming to time the market isn’t a good strategy – there are too many factors at play for that to even be possible.

That’s why experts usually say time in the market is better than timing the market.

In other words, if you want to buy a home and you’re able to make the numbers work, doing it sooner rather than later is usually worth it. Bankrate explains why:

“No matter which way the real estate market is leaning, though, buying now means you can start building equity immediately.”

Here’s some data to break this down so you can really see the benefit of buying now versus later – if you’re able to. Each quarter, Fannie Mae releases the Home Price Expectations Survey. It asks over one hundred economists, real estate experts, and investment and market strategists what they forecast for home prices over the next five years. In the latest release, experts are projecting home prices will continue to rise through at least 2029 – just at a slower, more normal pace than they did over the past few years.

But what does that really mean for you? To give these numbers context, the graph below uses a typical home value to show how it could appreciate over the next few years using those HPES projections (see graph below). This is what you could start to earn in equity if you buy a home in early 2025.

In this example, let’s say you go ahead and buy a $400,000 home this January. Based on the expert forecasts from the HPES, you could gain more than $83,000 in household wealth over the next five years. That’s not a small number. If you keep on renting, you’re losing out on this equity gain.

And while today’s market has its fair share of challenges, this is why buying is going to be worth it in the long run. If you want to buy a home, don’t give up. There are creative ways we can make your purchase possible. From looking at more affordable areas, to considering condos or townhomes, or even checking out down payment assistance programs, there are options to help you make it happen.

So sure, you could wait. But if you’re just waiting it out to perfectly time the market, this is what you’re missing out on. And that decision is up to you.

Bottom Line

If you’re torn between buying now or waiting, don’t forget that it’s time in the market, not timing the market that truly matters. Let’s connect if you want to talk about what you need to do to get the process started today.

- Courtesy of Keeping Current Matters

Market Update

December 2024

I hope you had a lovely Thanksgiving and have a lot to look forward to this month.

We are overdue for a market update. Last time I shared these numbers we only had 2024 data for January through March. A lot has happened since the spring, and we are now able to get a sense of whether those changes have impacted home sales in Northern Virginia.

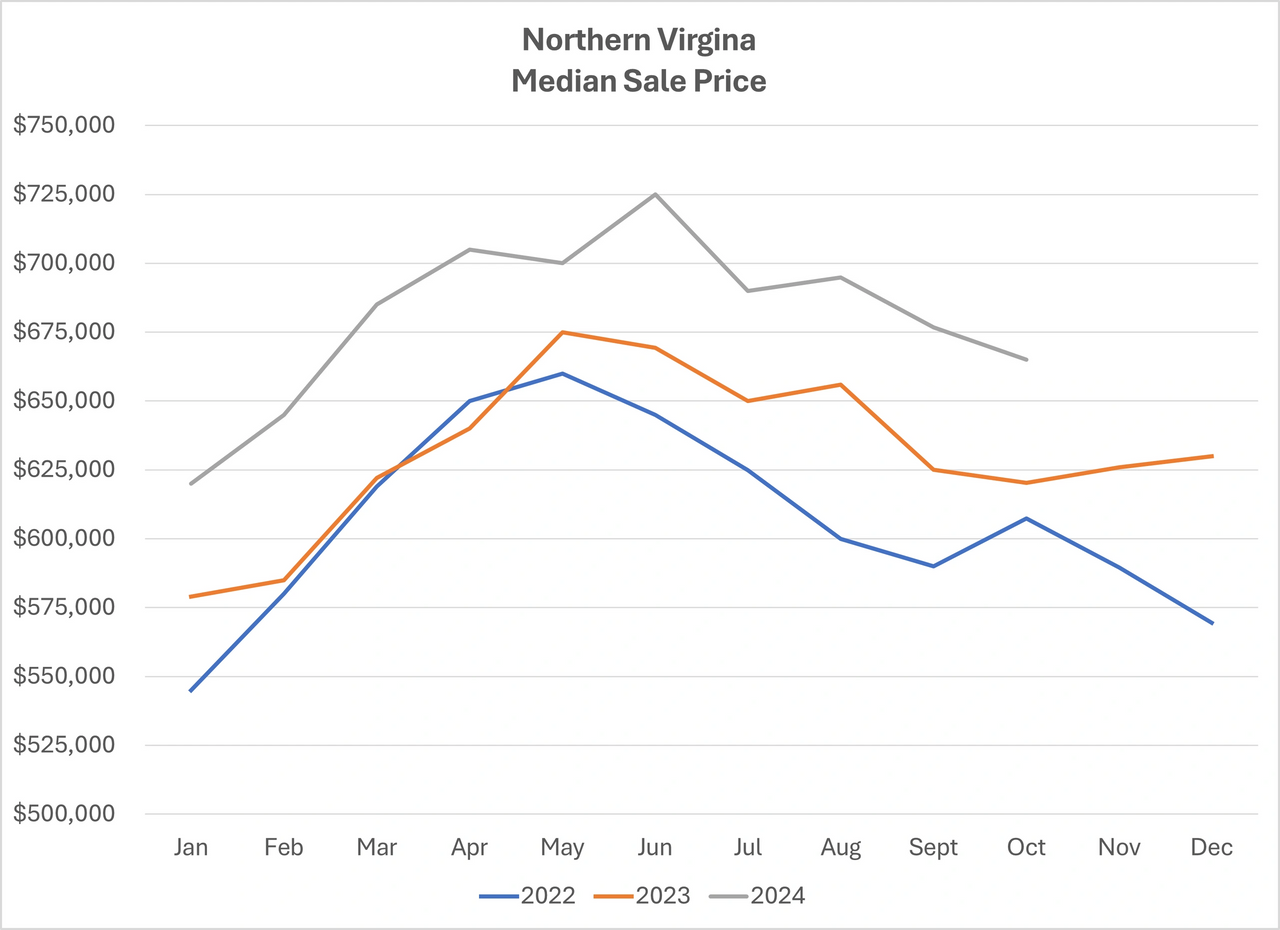

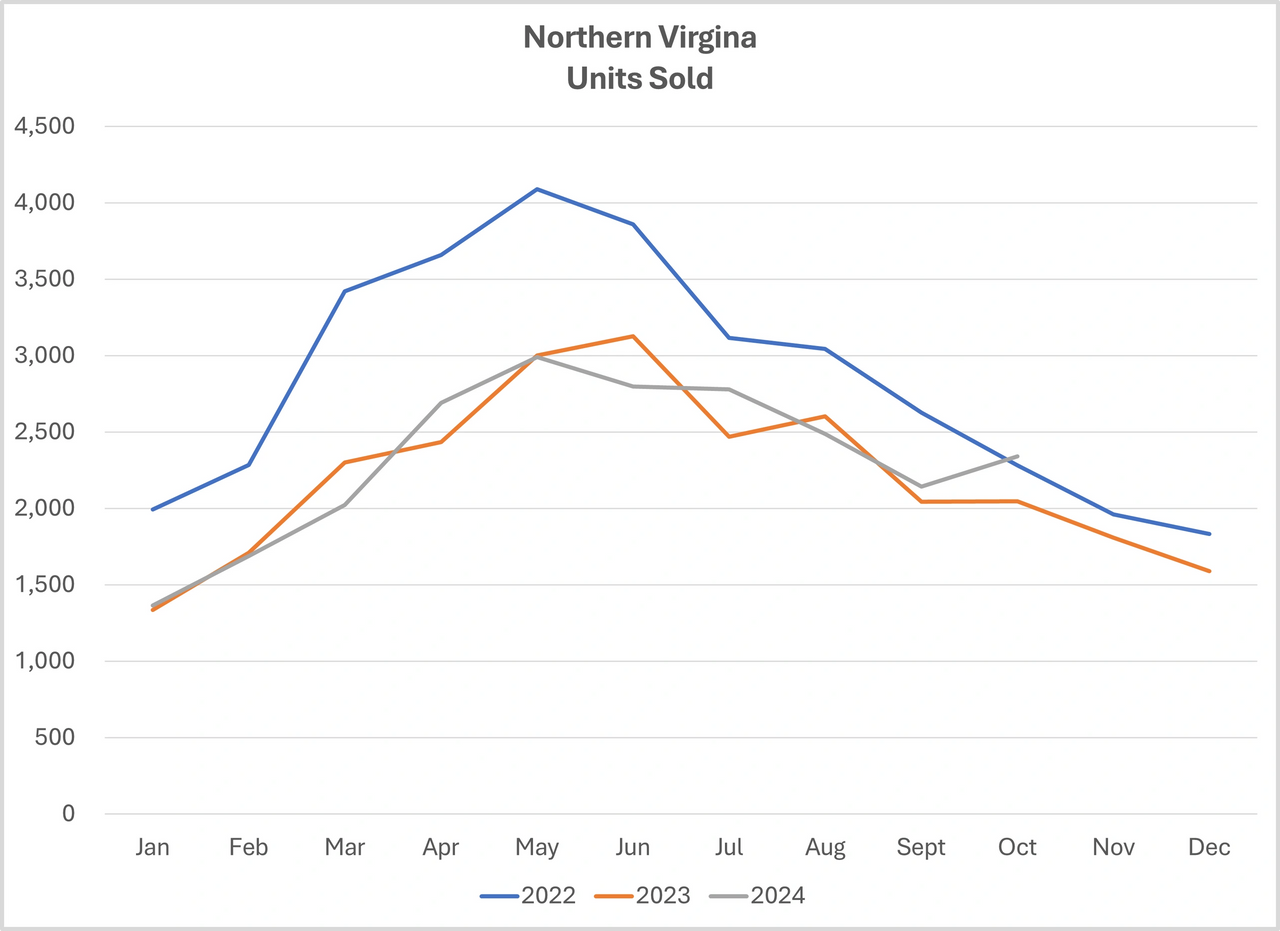

Please note both charts represent all residentials sales (condos, townhomes, single family) among Northern Virginia (Arlington, Alexandria, Fairfax, Loudoun, and Prince William Counties and their jurisdictions). The first chart indicates the median final sale price per month. As noted in the past, it does not reflect is the variance between the original list price, contract price, final sale price, or concessions. All important considerations when pricing your home or making an offer. The chart simply reflects whether final sale prices throughout our region are higher or lower than prior months and years.

As you can see, prices in 2024 have remained higher than the two previous years. Home prices dipped a little in May compared to last year when they increased. There was also a spike in June which debunks the myth of a spring market. July and August’s median sale prices are only slightly lower than May’s.

It is difficult to discern how many closings since August were under contract prior to the changes due to the National Association of Realtors (NAR) lawsuit. Regardless, the prices in recent months are still higher than the fall of 2022 and 2023. Some predicted the prices would decrease as interest rates increased. Again, that assumption was not accurate for Northern Virginia.

Many buyers are waiting for “the crash.” Check out the Two Reasons Why the Housing Market Won’t Crash blog to find out why a crash is not likely. Others are waiting for the interest rates to decrease, yet there is no prediction of another historical event. While current rates seem high compared to previous years, they are still below the historical average. Lastly, if you are saving for your down payment consider the continuous increase in prices. For instance, 20% for the average home price now will not equate to 20% in the future. Unless the amount of savings and the return can outpace inflation, reaching the goal is exceptionally difficult.

What I find interesting about the next chart is the number of homes sold in October is slightly less than last year, yet the median sale price is approximately $45,000 more. Also, May had the highest number of sales but not the highest price point.

The best time to sell is highly dependent on multiple factors. It is important to keep in mind the time it takes to prepare your home for a smooth process. Most of these sales were under contract 30-45 days prior to closing. Prior to being under contract, they were active on the market for a few days to many weeks. If you plan to sell in the spring, now is the time to begin the process.

I find these charts useful to get a sense for trends, although they are not a substitute for hyper-local data. Every sale and purchase is as unique as the people I get to represent. I would love to know your thoughts! Drop me a line to continue the discussion or if you would like data for your neighborhood.

From my family to you and yours, I wish you the best this season offers!

Two Reasons Why the Housing Market Won’t Crash

October 2024

You may have heard chatter recently about the economy and talk about a possible recession. It's no surprise that kind of noise gets some people worried about a housing market crash. Maybe you’re one of them. But here’s the good news – there’s no need to panic. The housing market is not set up for a crash right now.

Real estate journalist Michele Lerner says:

“A housing market crash happens when home values plummet due to a lack of demand for homes or an oversupply.”

With that definition in mind, here are two reasons why this just isn’t on the horizon.

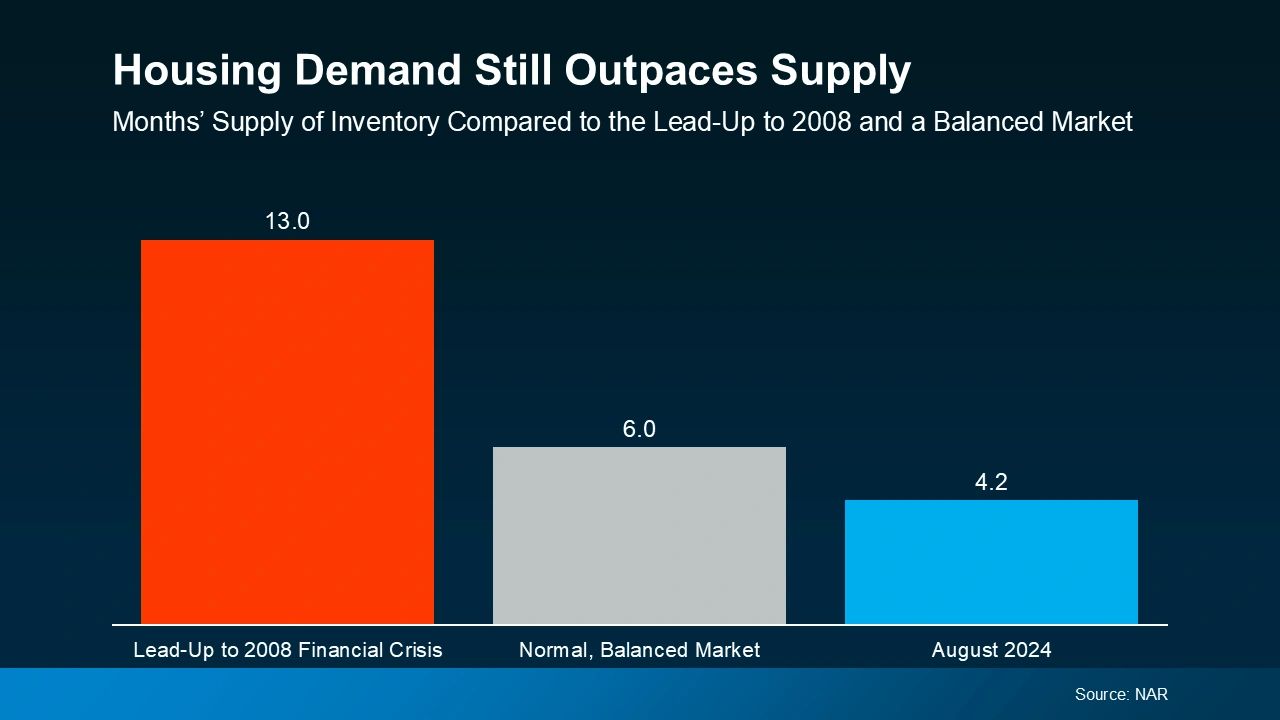

1. Demand for Homes Is Higher than Supply

One of the biggest reasons the housing market crashed back in 2008 was an oversupply of homes. Today, though, it’s a very different story.

It’s a general rule of thumb that a market where supply and demand are balanced has a six-month supply of homes. A higher number means supply outpaces demand, and a lower number means demand outpaces supply. The graph below uses data from NAR to put today’s situation into context:

The graph compares housing supply during three different periods of time. The red bar shows there were 13 months of supply before the 2008 crisis, which was far too much. The gray bar shows a balanced market with six months of supply, for context. And the blue bar shows there are only 4.2 months of supply today.

Put simply, there are more people who want to buy homes than there are homes available to buy right now. So, demand is greater than supply. When that happens, home prices stay steady or rise – the opposite of a housing market crash.

It’s important to note that inventory levels differ from market to market. Some areas may be more balanced, while a few could have a slight oversupply, which can impact prices locally. However, most markets continue to experience a shortage of homes.

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“We simply don’t have enough inventory. Will some markets see a price decline? Yes. [But] with the supply not being there, the repeat of a 30 percent price decline is highly, highly unlikely.”

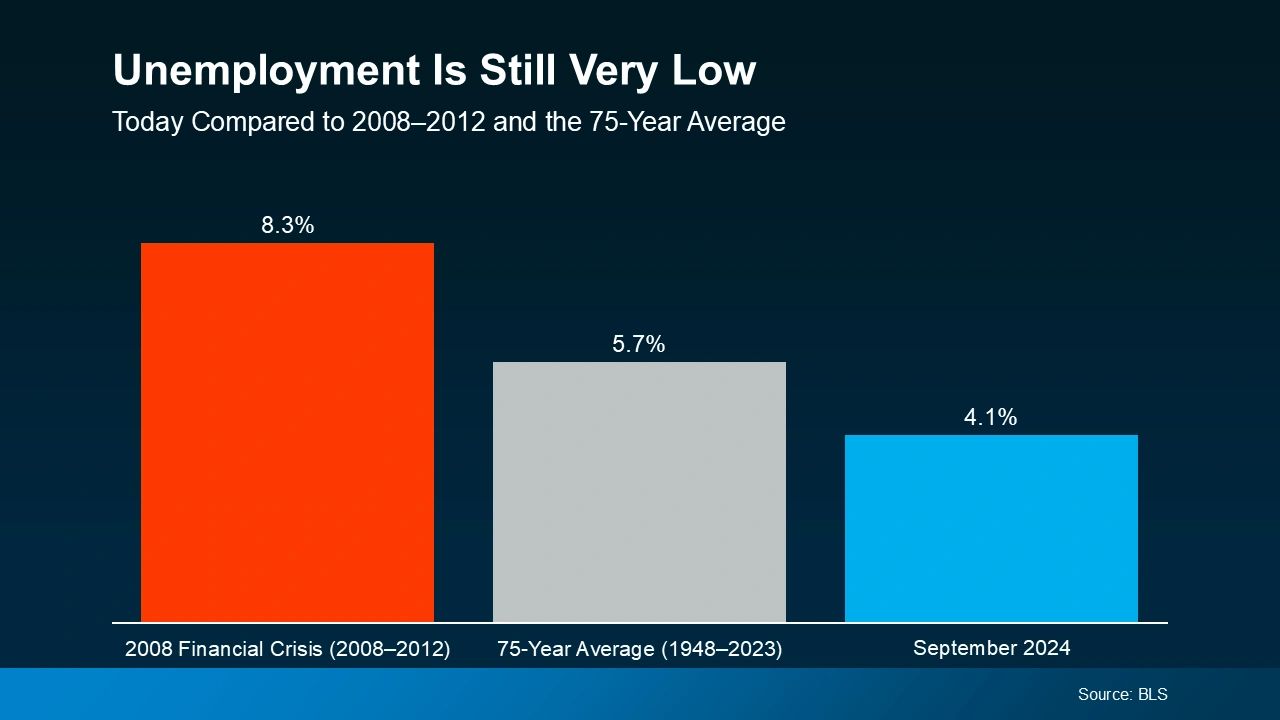

2. Unemployment Is Still Low

When people are unemployed, they’re more likely to have trouble making their mortgage payments and may be forced to sell or face foreclosure. That was a big problem during the 2008 financial crisis. Today, the employment situation is much more stable.

Again, this graph shows three different periods of time, but this one is the unemployment rate. The red bar represents the 2008 financial crisis when unemployment was very high at 8.3%. The gray bar shows the 75-year average of 5.7%. And the blue bar shows the unemployment rate today, and it’s much lower at just 4.1%.

Right now, people are working, earning an income, and making their mortgage payments. That’s one reason why the wave of foreclosures that happened in 2008 isn’t going to happen again this time. Plus, since so many people are employed right now, many are actually in a position to buy a home, and this demand keeps upward pressure on prices.

Today’s Housing Market Is Stronger than in 2008

While it’s understandable to be concerned when you hear talk of a recession and economic uncertainty, but know this: the housing market is in a much better place than it was in 2008. Accordingto Rick Sharga, Founder and CEO at CJ Patrick Company:

“Literally everything is different about today’s housing market dynamics than the conditions that led to the housing crisis.”

Demand for homes still outpaces supply, and unemployment remains low. And these are two key factors that will help prevent the housing market from crashing any time soon.

Bottom Line

The housing market is doing a lot better than it was in 2008, but it’s important to remember that real estate is very local.

So, it’s always a good idea to stay informed about our specific market. If you have any questions or want to discuss how these factors are playing out in our area, feel free to reach out.

- Courtesy of Keeping Current Matters

What's the Impact of Presidential Elections on the Housing Market

September 2024

It’s no surprise that the upcoming Presidential election might have you speculating about what’s ahead. And those unanswered thoughts can quickly spiral, causing fear and uncertainty to swirl through your mind. So, if you’ve been considering buying or selling a home this year, you’re probably curious about what the election might mean for the housing market – and if it’s still a good time to make your move.

Here’s the good news that may surprise you: typically, Presidential elections have only had a small, temporary impact on the housing market. But your questions are definitely worth answering, so you don’t have to pause your plans in the meantime.

Here’s a look at decades of data that shows exactly what’s happened to home sales, prices, and mortgage rates in previous Presidential election cycles, so you can move forward with the facts as you weigh the pros and cons of your homeownership decision.

Home Sales

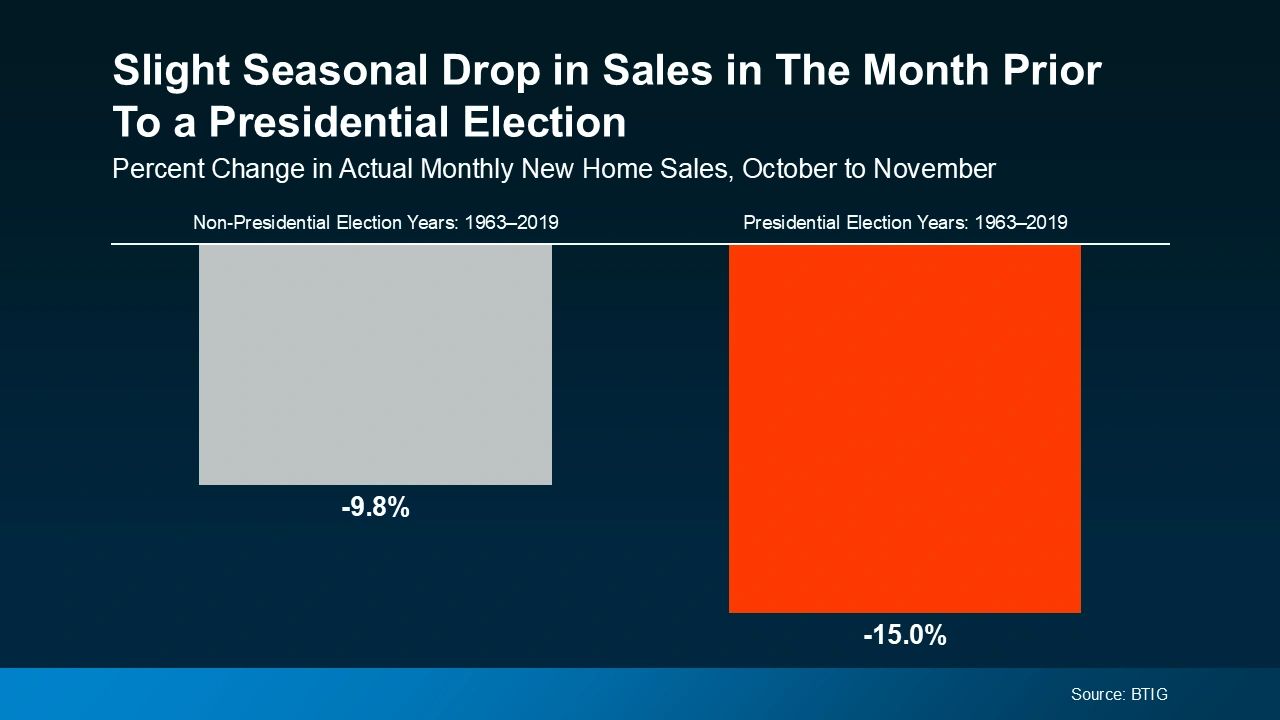

In the month leading up to a Presidential election, from October to November, there’s typically a slight slowdown in home sales.

Some consumers will simply wait it out before they make their purchase decision. However, it’s important to know this slowdown is small and temporary.

Historically, home sales bounce right back and continue to rise the following year.

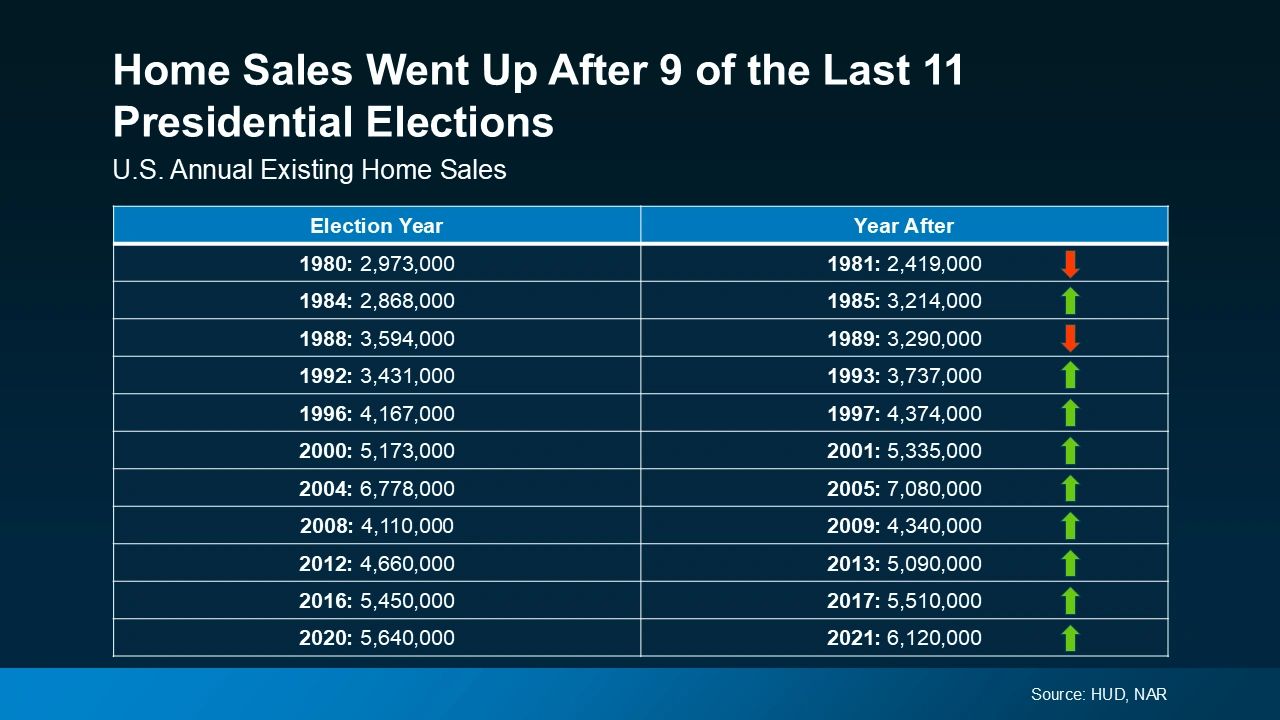

In fact, data from the Department of Housing and Urban Development (HUD) and the National Association of Realtors (NAR) shows after 9 of the last 11 Presidential elections, home sales went up the year after the election, and it’s been happening consistently since the early 1990s.

Home Prices

You may also be wondering about home prices. Do prices come down during election years? Not typically. As residential appraiser and housing analyst Ryan Lundquist notes:

“An election year doesn’t alter the price trend that is already happening in the market.”

Home prices generally rise over time, regardless of an election cycle. So, based on what history shows, you can expect the current pricing trend in your local market to likely continue, barring any unusual market or economic circumstances.

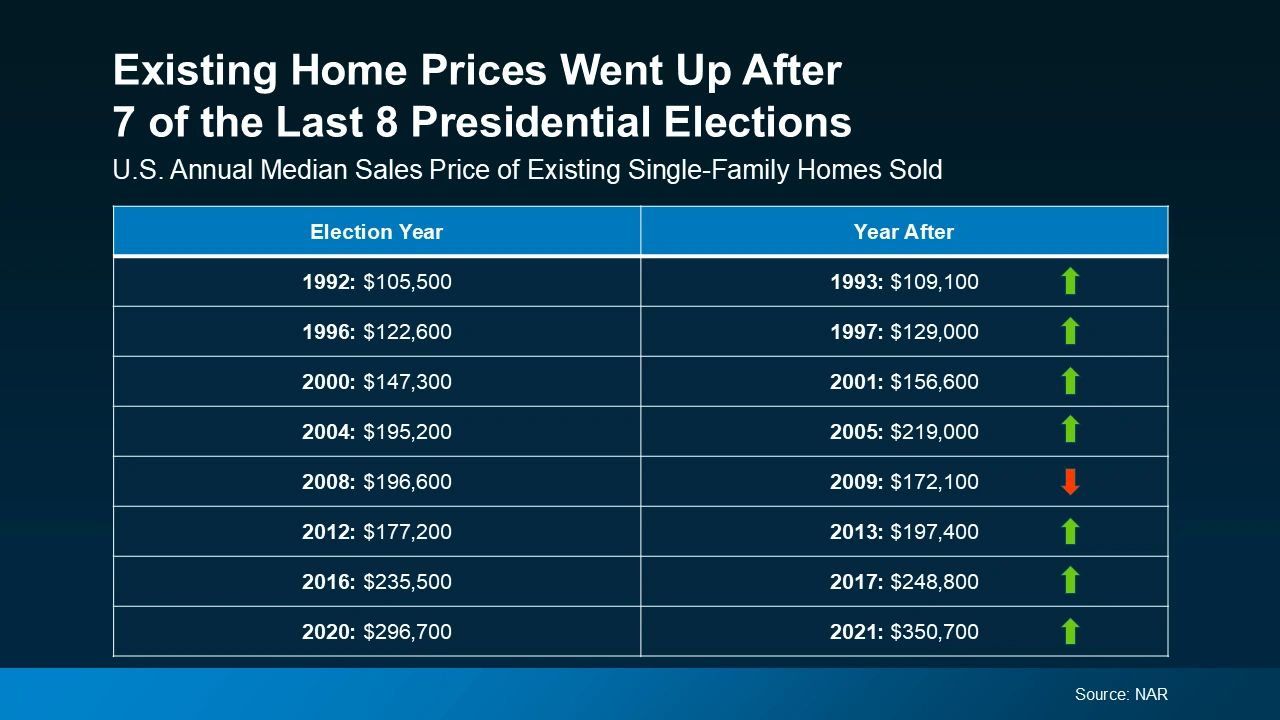

The latest data from NAR reveals that after 7 of the last 8 Presidential elections, home prices increased the following year.

The one outlier was from 2008 to 2009, which was during the height of the housing market crash. That was certainly not a typical year. Today’s market, however, is much more resilient. And while prices are moderating nationally, they aren’t on an overall decline.

Mortgage Rates

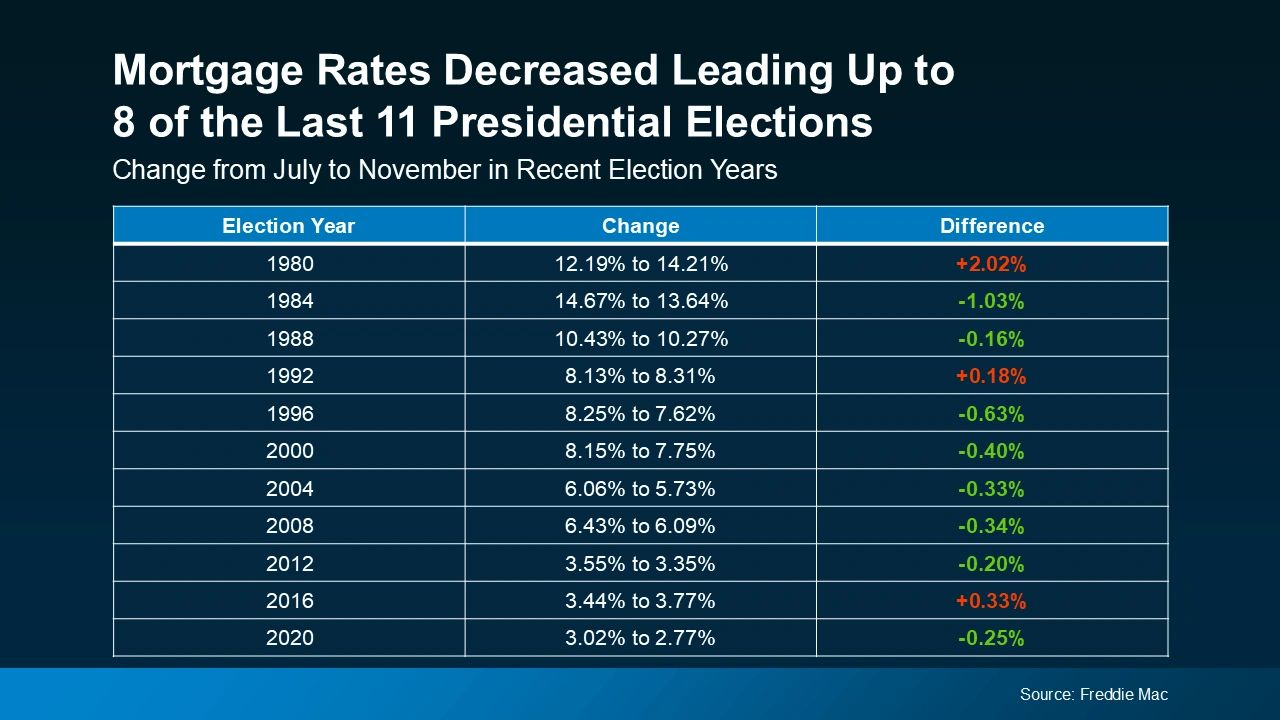

And the third thing that’s likely on your mind is mortgage rates, since they impact your monthly payment if you’re financing a home. Looking at the last 11 Presidential election years, data from Freddie Mac shows mortgage rates decreased from July to November in 8 of them.

And this year, we’ve already started to see that happen. Most experts also forecast mortgage rates will ease slightly throughout the rest of 2024. If that happens – and all signs right now indicate it should – this year will continue to follow the trend of declining rates. So, if you’re looking to buy a home in the coming months, this could be great news for your purchasing power.

What This Means for You

What’s the big takeaway? While Presidential elections do have some impact on the housing market, the effects are usually minimal. As Lisa Sturtevant, Chief Economist at Bright MLS, says: “Historically, the housing market doesn’t tend to look very different in presidential election years compared to other years.”

For most buyers and sellers, elections don’t have a major impact on their plans.

Bottom Line

While it’s natural to feel a bit uncertain during an election year, history shows the housing market remains strong and resilient. And this means you don’t have to pause your plans in the meantime. For help navigating the market during this election cycle, let’s connect.

- Courtesy of Keeping Current Matters

Hello August

August 2024

Happy August! I hope you have found ways to beat the heat this summer!

Since my last email I have done some work on my website. I have added a Resources page and a Blog section. As of now the blogs consist of recent newsletter letters. In time this will grow and will include more topics. Your feedback and suggestions, for the website or content, are always greatly appreciated!

Until recent weeks the National Association of Realtors (NAR) lawsuit had little impact on how we conduct business. The result of the lawsuit has changed the standard contract and required forms, which are already updated semiannually. However, the biggest change, the one people want to understand most, is how buyer representation is paid. Since this information is no longer permitted in the Multiple Listing Services (MLSs) and therefore will not feed to the commercial sites, how do buyers know whether a seller intends to pay for this expense?

We ask! The standard Northern Virginia Association of Realtors (NVAR) contract now has language to account for buyer representation. Like all other aspects of the contract (i.e. price, contingencies, dates), it is part of negotiations. Meanwhile, lenders will be factoring it into the buyers’ closing costs and it will be reflected on the American Land Title Association (ALTA) statement as a payment from the buyer to the buyer agent’s broker. Any version (i.e. the seller pays for the expense or for part) will be outlined in the ALTA accordingly.

Some believed changing the structure of buyer agency compensation would lower sale prices. It will take some time to determine if this factor alone can reduce sale prices. There is still a lack of inventory (not enough homes for sale) and the interest rates have dropped a bit. Historically, a large shift in prices one way or the other is a result of multiple factors. The results of the suit remain to be seen.

As many of you know, I frequently work with downsizers. Often people want a simpler living situation, and for some, that does not involve moving. Reston for a Lifetime recently published resources to help prepare your home to meet new challenges. There are comprehensive lists of considerations for you, or someone you know plans to “age in place.” click here

Another resource I recently learned of is Honor Flight. The Virginia Hub is a local nonprofit organization creating ways to transport veterans to our nation’s memorials. The next mission will be on September 28 in Harrisonburg. To check for eligibility and/or find way to support the cause, check out their website!

Best wishes as you wrap up your summer! Sending my teacher friends and parents good vibes! I’ll be in touch again soon. And don’t forget, I am just a phone call away in the meantime.

Hello July

July 2024

June went by in a flash and summer is in full swing! I hope yours is off to a great start. I began writing this newsletter weeks ago and have had to make many changes through the delay…everything from community events, where to watch fireworks, the National Association of Realtors (NAR) settlement.

Last month the NAR lawsuit had received preliminary approval. Since that time, Bright MLS, our local Multiple Listing Service (MLS) has been preparing for the changes as a result of the suit. The changes become effective in mid-August. Our local association, Northern Virginia Association of Realtors (NVAR), which is responsible for standard forms and contracts in our area, just released the latest versions of the contract. There have been several emails, discussions, and a lot of training.

Some believe the changes are premature given the status of the suit and some anticipate the result of the suit will drag on beyond August. Apparently, the Department of Justice (DOJ) has rejected the latest versions of the California Association of Realtors (CAR) forms. There is also confusion about which spin-off lawsuits align with the NAR settlement. Meanwhile, a Massachusetts MLS is arguing DOJ’s interference violates free speech. There is no shortage of drama.

I can attest there has been little change in our practice and means of compensation for buyer representation, so far. A few small turns in the route have changed but the destination is the same. Business as usual. If you are waiting for the dust to settle before buying or selling, don’t.

On another note, I recently met with 123 Junk. Despite its name, it is a great company providing great service. They have offered a 10% discount to anyone presenting the coupon below. If you could use some help parting with items around the home, 123 Junk might be a great resource for you.

If you are still looking for a place to see fireworks, it is not too late! Check out these links: Independence Day | Celebrations & Fireworks

Wishing you the very best this season as you gather with friends and family, and travel. I will be back in touch by the end of summer. Drop me a line in the meantime if I can be a resource for you or just to say hi.